|

|

Keep up-to-date with us and what's happening in the business world

- Business expenditure: now or later?

- Thinking about contracting?

- IRD are targeting property investors

- Working solo? Tips to stay mentally well

- Exclusive offer from PaySauce

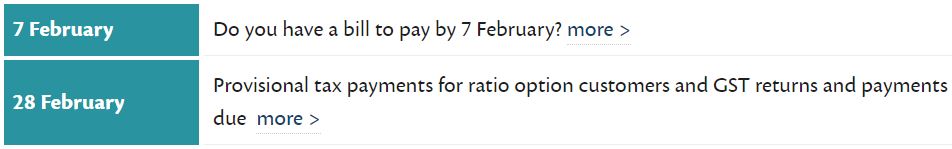

- Upcoming tax dates

|

|

|

|

Business Expenditure - Now or Later?

One thing you can do now to put yourself in the best position heading into the 2021 financial year is think about the timing of business purchases and expenses. Expenses reduce your taxable profit and therefore the amount of tax your business needs to pay. Any expenses incurred before year end (31 March) will be recognised in the 2020 tax year, in turn reducing your tax for 2020 tax year. Although expenses paid after year end will still be deductible, you will have to wait an additional 12 months to realise the tax benefits.

For example, if you are planning to have your rental property painted before winter sets in, you could substantially reduce your taxable income for 2020 tax year by ensuring it is done before 31 March. If the rental property made a loss for 2020 tax year, this would be carried forward to offset future years profit.

Although there is a tax benefit in incurring expenses prior to 31 March, this investment should still be considered from the business perspective first and foremost, with tax deduction being a secondary benefit. There is no point in purchasing items not required for your business in order to save on tax as for every $100 spent you will at best save $33 of income tax.

If you would like to discuss your particular situation, please get in touch with us.

|

|

Thinking about contracting?

If this applies to you, read this article from business.govt.nz. There are many benefits to working as a contractor - it can pay better than doing a similar salaried job and be more flexible. But there are hidden costs to think about too, such as covering the costs of sick leave, holiday pay, ACC levies and insurance. Contact us if you need help deciding if going contracting is right for you.

IRD targeting property investors

There was an article in Stuff last week reporting that the IRD are targeting property investors. Their current focus is on identifying transactions that should be caught by the brightline test, which requires that tax is paid on gains from investment properties bought since October 2015 and sold within 2 years, or bought since March 2018 and sold within 5 years. If you have any questions, get in touch.

Working solo?

There is nothing more important than your mental health. Click on the button below for some tips on keeping mentally well and socially connected from business.govt.nz. Also remember that the Xero Assistance Programme is available free to those on Xero Starter, Standard & Premium plans, as well as their employees and families. Check out our blog with all the details HERE.

|

|

PaySauce is all about making life as an employer easier. Running a business is pretty hectic without the added stress of paying staff, so PaySauce takes care of it for you. Calculations, timesheets, payslips, staff payments, leave and IR filing, all from your mobile or computer.

Got a mix of salaried and hourly staff? No sweat. PaySauce can handle the lot. Your staff can enter hours, review and request leave, and manage their own payslips, all from the mobile app. The clever system can handle all sorts of tricky payroll scenarios, including variable rates and specific allowances. And to cap it all off, PaySauce connects with the big banks, the little banks, Xero, and a bunch of other employment software.

Payroll and accounting go hand in hand, so PaySauce is working alongside your accountant to look after our shared customers. To help bring you on board we’re offering $50 credit to any All Accounted For clients who join up with PaySauce before 1 April 2020. Just let PaySauce know All Accounted For sent you when you sign up online, and we’ll get you up and running with $50 to burn. Plus free set-up, training and ongoing support. Nice.

To find out more feel free to chat with All Accounted For or call PaySauce directly on 0800 746 701.

|

|

|

|

|

|