|

|

|

|

June 2020

Keep up-to-date with us and what's happening in the business world

- COVID-19 Income Relief Payment

- Wage Subsidy Extension - Recap

- Small Business Cash Flow Loans - Recap

- Change to Tax Payments at Westpac Branches

- ACC Levies Invoices Delayed Until October (changed from July)

- Healthy Homes Standards - Are Your Rental Properties Compliant?

- Summary of Financial and Tax Legislative Changes (17 June 2020)

|

|

COVID-19 Income Relief Payment

If you lose your job (including self-employment) due to COVID-19 from 1 March 2020 to 30 October 2020, you may be eligible for the COVID-19 Income Relief Payment.

You can get up to 12 weeks of payments, to help with living costs, giving you time to find other work.

You can't get the Income Relief Payment at the same time as another main benefit. In most cases, if you lost a full-time job of 30 hours or more a week, you'll be better off financially on the Income Relief Payment instead of a main benefit.

You can get:

$490 a week, if you worked 30 hours or more a week, or

$250 a week, if you worked 15 to 29 hours a week.

If you, or someone you know is, or could be in this situation, read more details on the Work and Income website below.

|

|

Wage Subsidy Extension

Employers, including sole traders, who are significantly impacted by COVID-19 may be able to apply for an 8-week extension of the Wage Subsidy to continue to pay themselves and their employees.

- You must have experienced a minimum 40% decline in actual or predicted revenue for a continuous 30 day period within the 40 days before you apply (but no earlier than 10 May 2020), when compared to the same (or closest) period last year.

- The decline in revenue must be related to COVID-19.

Small Business Cash Flow Loans

The final application date for the Small Business Cash Flow Loan Scheme has been extended from 12 June 2020 to 24 July 2020. If you meet the criteria and are wanting to take advantage of this support, there is still time to get your application completed.

Although this is a loan and must be repaid, it provides access to much needed liquidity at an interest rate that is generally well below commercial lending levels.

|

|

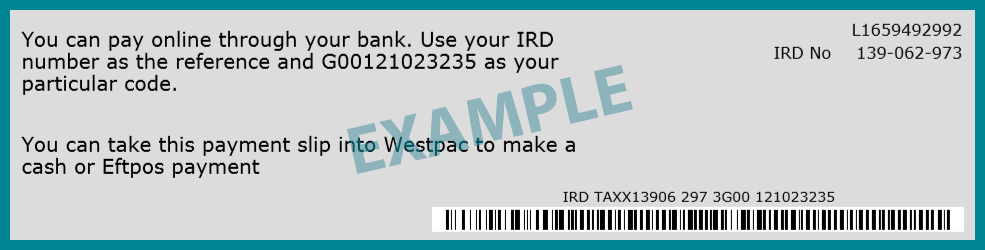

Change to Tax Payments at Westpac Branches

If you make tax payments at a Westpac branch or Smart ATM, you’ll now need to have a barcode to ensure the payment goes to the right place. Barcodes are usually printed on Inland Revenue returns, statements or letters.

There are also several other payment methods available:

Pay online through the bank

You can make payments to IRD through your bank’s online banking facilities. This is fast, easy, secure and you can post-date the payment, making it easy to set up the payment as soon as you receive your tax payment slip.

Pay online in myIR

Make payments securely using your credit or debit card in myIR online services.

Automatic payments and direct debits

These options are best suited for fixed or regular payments, such as debt or arrears. You can set up automatic payments within your online banking, or download direct debit forms from the IRD website.

|

|

ACC Levies Invoices Delayed Until October

Invoices for the 2020/21 financial year would usually be issued from 1 July 2020, but will now be issued in October 2020. Other invoices issued throughout the year will also be on hold for three months. Payment options will be available once we send invoices.

The delay in invoicing adds to the support that ACC already have in place:

- Delayed CoverPlus Extra (CPX) invoicing by three months (usually sent on 1 April).

- Proactive collections and recovery activity (including Collection Agencies) has stopped and manual holds are on as many system-generated communications as possible. Collections & Recovery are providing payment options to businesses unable to make payment.

Healthy Homes Standards

The deadline for landlords to provide a compliance statement for the Healthy Homes Standards has been extended to 1 December 2020 (was 1 July 2020). The compliance statement must be provided within new and renewed tenancy agreements, detailing how the rental property complies, or will comply with the Healthy Homes Standards.

By 1 July 2021, private landlords must ensure that their rental properties comply with all aspects of the Standards within 90 days of new or renewed tenancies.

We recommend landlords adhere to all aspects of the Healthy Homes Standards as soon as possible and before 1 July 2021. Read our latest blog for more details, as well as tips for keeping your rental properties warm and dry this winter.

|

|

Summary of All Financial and Tax Measures To Date

CThe key financial impacts from legislative and tax changes to date are:

- Wage Subsidy Scheme ($585.80 or $350.00 per week for employee wages for 12 weeks), extended from 10 June 2020 for 8 weeks for business having suffered 40% revenue decline compared to 2019 for the 30 days prior to date of application;

- Depreciation reintroduced on commercial and industrial buildings from 1 April 2020 (2% diminishing value per annum);

- Increased provisional tax threshold (from $2,500 to $5,000);

- Expenditure threshold for low value assets increased to $5,000 from 17 March 2020 for 12 months, then $1,000 post 17 March 2021;

- Research & Development tax credits brought forward (ability to claim credits for 2019-20 tax year against other tax types);

- Use of money interest and penalty remission around late tax payments, if business impacted by COVID-19;

- Removal of working hours requirement for In Work Tax Credit for Working for Families;

- Winter energy payment increase for eligible recipients ($450 to $900);

- Loss carry back scheme (ability to offset expected losses from 2021 back to 2020 or losses from 2020 back to 2019, to generate tax refunds or lower tax payments);

- Small business cashflow scheme (Up to $100,000 interest free for 12 months, loans for up to 5 years) - application date deadline extended to 24 July 2020; and

- Income Relief Payment - up to 12 weeks of payments if you lose your job (including self-employment) due to COVID-19 from 1 March 2020 to 30 October 2020.