|

|

Keep up-to-date with us and what's happening in the business world

- Competitions and promos for October

- Changes to employer-assisted temporary work visas

- Accommodation for workers - what you need to know

- IRD targeting Hospitality sector

- Want to improve your cashflow?

- Introducing our new Office Administrator, Lisa

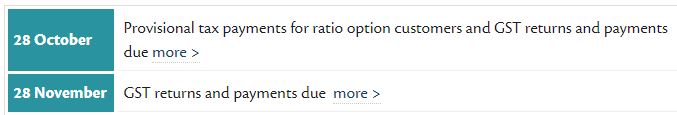

- Upcoming Tax Dates

|

|

October Competitions & Promos

|

|

|

|

Half- yearly business check

It’s over half way through the tax year! If you are not signed up to a regular management reporting package with us, let us know if you would like us to complete a one-off check to see how your business is tracking half-way through the year.

Or perhaps you want to kick things into gear and want some help in setting some goals for the remainder of the financial year? Let us know if you would like us to sit down with you for a consultation meeting to discuss and get some plans in place.

|

|

Refer a friend to get a credit on your account

Do you know someone that could benefit from our expertise and services? Refer a friend, colleague or acquaintance to All Accounted For and if they sign up with us by the end of October, we'll give you a $250 credit against your accounting fees. It's win-win!

|

|

|

|

Changes to employer-assisted temporary work visas

Minister of Immigration, Hon Iain Lees-Galloway has announced a new temporary work visa process. “The new visa system will require all employers to be accredited and will give employers more certainty about their ability to hire a foreign worker earlier in the application process.”

The new visa application process aims to result in a number of benefits, including:

- A simplified system for both employers and foreign workers, with only one visa (the Temporary Work Visa) instead of six

- More certainty for employers around their ability to hire a foreign worker, by having more upfront checks and a streamlined process for genuine higher-skilled jobs

- Immigration settings that better recognise different regional and sectoral labour market needs

- Establishing clear minimum standards for employers to employ foreign workers, to better screen out misuse of the immigration system and exploitation, and to better target compliance activity

- Increased incentives on employers to recruit and train New Zealanders and to respond to skill and labour shortages.

The changes will be implemented in stages - see the link below for details on what changes may affect your business and when they come into effect.

|

|

Accommodation for workers

If you offer seasonal or casual work, it's important to know the rules around providing accommodation to your workers and also distinguishing between employees and volunteers.

Read more at business.govt.nz at the link below:

- Employee vs. volunteer

- Minimum standards for employees

- Can you pay a person with accommodation?

- Are your employees also your tenants?

- Tax you might have to pay or can claim

- Health and safety

IRD targeting hospitality sector

The latest announcement from the IRD is a campaign targeting the hospitality sector, in particular; those receiving cash. IRD spokesperson Richard Philp says "Cash sales don’t fly under the IR radar and people who accept cash and don’t put it through the till should expect contact from IR.”

At AAF, we are completely onside with his advice: “Our best advice is to record everything, declare every dollar and make sure you’re charging GST if required. ....knowing the books are all in good order takes a huge weight off a business owner’s shoulders. It not only helps with tax obligations but also provides a more accurate view of cash flow, allows greater access to finance and ensures a business is correctly valued."

|

|

Want to improve your cashflow?

Here are some easy, practical ways to get that cash rolling in.

Automatic invoice reminders

You can set these reminders to go out to clients at set intervals after the invoice due date. Sometimes this is all the prompt that customers need to make that payment.

Accurate bank reconciliation

Regular and correct reconciling of your bank transactions is crucial in managing your cash position, identifying when clients haven't paid and allows you to forecast and plan for the future.

Allow debit and credit card payments via Stripe

Stripe is a payment service that connects with accounting software such as Xero and enables your clients to pay their invoices with a debit or credit card. You can set it up to pass on Stripe's transaction fees to your customers, so that you don't lose out.

|

|

New Office Administrator

Lisa Ruthven

With over 15 years administration experience in an accounting practice, Lisa is a great addition to our growing team. Lisa enjoys the client contact offered in the administration role, and is looking forward to meeting all our clients over the coming months.

Lisa is married with two children, a son and a daughter. In her spare time Lisa enjoys spending time with her family and friends, dining out and going to the movies. Originally from Blenheim, Lisa grew up in West Auckland before finally settling in Wellington.

|

|