"Our mission is to empower business owners and their staff, with the knowledge and tools to ensure they thrive in their field"

|

|

Whether you’re in full lockdown, restricted trading conditions or back to ‘business as usual’, there’s still real uncertainty for business owners. We’re trading in challenging times at present. And knowing what step to take next is a key worry. We know that you invest more than simply time and money into your business. It is more than a job but part of your identity.

So, how do you get more clarity around your future plans? And how do you work on the short-term future of the business, when sales, income and cash are in short supply?

Focusing your efforts in the right places

Planning the next business move is difficult at the best of times, but it’s doubly problematic when we have so little clear idea of what a post-COVID19 business world will look like.

It's difficult to plan when we don't know what will be possible. What regulations will be in place once you can begin trading? Will the market have changed dramatically? Will you be able to trade over borders and continue to be an international operation? Will you have enough cash to actually operate?

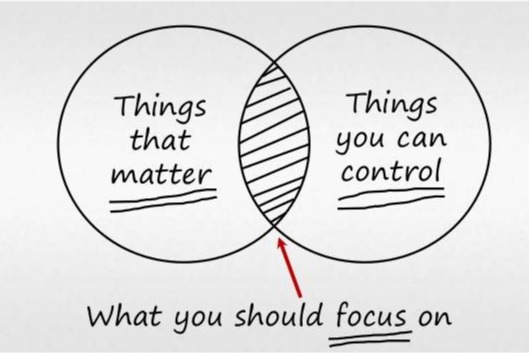

As a business owner, you’ll be continually thinking of new business-critical issues to add to this list – but the reality is that you CAN’T control all these elements. This sense of mounting uncertainty is likely to raise your stress levels and make you more anxious.

So, how do you overcome these worries and find a practical solution?

Try to focus on the things you can control:

- Identify the things that matter to the short and long-term success of the business

- Find the things you can control and over which you have some influence.

It's too overwhelming to try and work on everything at the same time. Instead, try to focus on the one thing you can achieve each day.

- Review your overheads and costs – one way to reduce your cashflow worries is to reduce your spending. Look at your controllable overheads and see if there are ways to negotiate better terms with suppliers, cut down on expenses or pause any subscriptions.

- Talk to debtors and creditors – if you can bring down your aged debt, that will help your overall financial health. Talk to any late-paying customers and agree when these debts will be paid. And talk to suppliers about extending payment terms, if possible.

- Consider alternative revenue streams – if your current business model doesn’t work well in lockdown, are there other online services that you could diversify into? Any new revenue streams will help to bolster your income and cash position.

- Update your website and marketing – having a great online presence is vital during this crisis, when most goods and services will be purchased online. Give your website a refresh and make it easy for potential customers to find and buy your services.

- Catch up with your team – maintaining contact with your employees is vital if you’re going to nurture team spirit. The more engaged your team is, the easier it will be to embrace change together.

Talk to us about other strategies for dealing with uncertainty.

If you’re uncertain about the impact of COVID-19 on your business, please do come and talk to us. We’ll help you get in control of your finances, prioritise the right elements of your business and find a strategy that prepares you for trading in the post-coronavirus market.

|

|

COVID-19 Wage Subsidy Extension

A Wage Subsidy Extension payment will be available to support employers, including sole traders, who are still significantly impacted by COVID-19 after the Wage Subsidy ends.

The Wage Subsidy Extension will be available from 10 June 2020 until 1 September 2020 so employers can keep paying their employees.

Below are some key points. More information about this payment and how to apply will be available before 10 June.

https://workandincome.govt.nz/covid-19/wage-subsidy-extension/index.html

|

|

XERO - Behind Small Business resources

Business continuity is more important than ever. We’re here to help you understand what government support you can get, teach you new skills, tips to take your business online or manage working remotely. We’re also sharing inspirational stories from the world of small business. This is just the beginning, so keep checking back on what more we can do.

https://www.xero.com/nz/behindsmallbusiness/

|

|

Some dates to remember

PAYE for April is due for payment 20 May.

GST for March & April due for filing and payment by 7 May 2020

Provisional Tax payment 3 is due for payment 7 May 2020 - standard method

|

|

|

|