|

|

Keep up-to-date with us and what's happening in the business world

- Business cash flow and tax relief measures

- IRD offline from 3pm April 9th to 8am April 16th

- 6-month freeze on residential rent increases

- Mortgage repayment holiday scheme

- 2020 annual accounts questionnaires

- Financial pressure and wellbeing resources

- Client profile on Anxiety Specialists

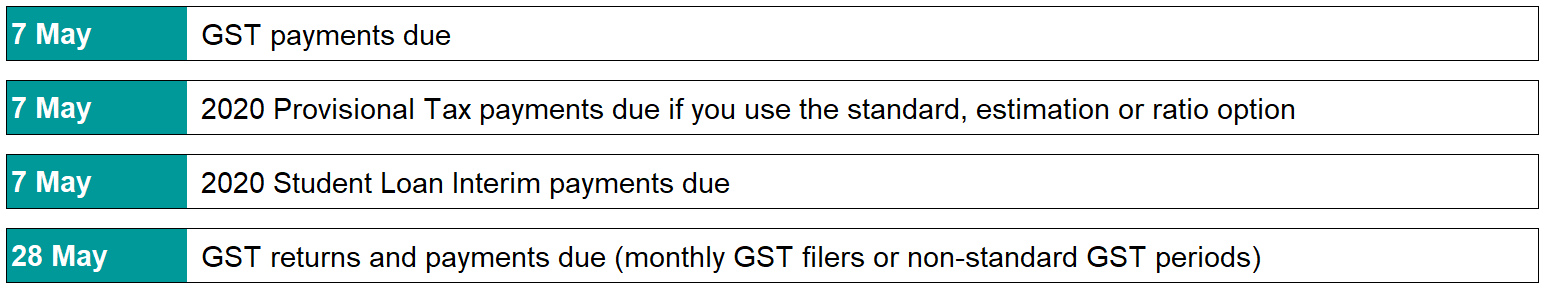

- Upcoming tax dates

|

|

|

|

Business cash flow and tax relief measures

IRD have put in place measures to provide some relief to tax payers, including the following:

- Increasing the provisional tax threshold from $2,500 to $5,000 from the 2021 tax year (1 April 2020)

- Temporarily increasing the small asset depreciation threshold to $5,000 for the 2021 tax year (until 16 March 2021)

- Permanently increasing the small asset depreciation threshold from $500 to $1,000 from the 2022 tax year (from 17 March 2021)

- Allowing depreciation on commercial and industrial buildings from the 2021 tax year

- Removing the hours test from the In-Work Tax Credit, from 1 July 2020

- Discretion to remit use-of-money interest (UOMI) applied on or after 14 February 2020, for taxpayers significantly adversely affected by COVID-19. This UOMI remittance policy is expected to be in place for a maximum of two years.

For those of you who have already set up payment arrangements with Tax Management NZ (TMNZ), you will continue to pay TMNZ as per the terms of the arrangement. If you have any concerns or queries about your tax obligations, please get in touch with the AAF team.

|

|

IRD offline for a week

IRD phone lines and myIR Secure Online Services will be unavailable from 3pm, Thursday 9th April to 8am, Thursday 16th April while system changes take place, including improvements to myIR, student loans and Kiwisaver. During this time, Inland Revenue is still working on all critical matters related to tax entitlements and payment obligations. Payments, including Working for Families, will still be made. If you receive weekly Working for Families payments and are expecting a payment on either Tuesday 14 April or Wednesday 15 April, you will receive your payment early, on Thursday 9 April or Friday 10 April.

Please note: If you have draft returns or draft secure mail in myIR, these will be deleted. Be sure to complete these before 3pm on Thursday 9 April so you don’t lose them.

You can still submit returns by E-File during this period, and they will be processed when the IRD is back online. You can also pay bills as you normally woudl through your bank account and access information on the Inland Revenue website.

|

|

Freeze on residential rent rises for 6 months

Landlords are prohibited from increasing rents on residential properties, for at least a 6 month period, when the Government will evaluate whether the period needs to be extended. Tenancies will not be terminated by the landlord during the lock-down period, regardless of when notice was provided and these protections against terminations will apply for an initial period of 3 months, when the Government will evaluate whether the period needs to be extended. Tenants can still terminate their tenancy as normal.

Mortgage repayment holiday scheme

New Zealand’s retail banks are offering to defer repayments for all residential mortgages for up to 6 months for customers financially affected by COVID-19. It’s important to note that interest on these loans will still accrue, and deferred interest will be added to the principal amount of the loan. Banks will assess the suitability for each customer who is asking for a deferral and each bank will have a different approach to how they determine eligibility. Customers should contact their bank for further details or queries about the scheme.

|

|

2020 annual accounts questionnaires

In the coming days, we will be sending out questionnaires in order to gather the information we need to complete your 2020 tax returns and annual accounts. This year, we will be sending these via an online form-based tool called Ask, which is a feature within Xero. This retains the information within your Xero account for easy reference for both the AAF team and yourself. For those of you without a Xero account, we are also able to send you the questionnaires via Ask. Please take the time to read through the questions and checklists that are relevant for both your personal and business accounts. They are an important part of the year-end process and help you:

- Identify and provide the additional information we need to prepare your accounts;

- Minimise the queries from us during the preparation of your accounts;

- Reduce the time taken by us to complete your annual accounts and tax returns; and

- Speed up the confirmation of your tax position for the next 12 months.

If you are unsure about any of the questions, contact the team for for clarification. You can also save the questions you have completed and at a later date go back to any that you need to clarify or find the answers to.

|

|

Options for those under financial pressure

The above video from Sorted.org.nz gives examples of some options to help assist with cash flow and relieve some immediate financial pressure. Talk to your bank, lending provider or to us at AAF if you would like assistance, or advise on any of these options.

Xero Assistance Programme

If you are feeling at all uneasy about the current situation, remember that as a Xero subscriber; you, your staff and your family have access to the Xero Assistance Programme. This is provided free of charge by the team at Xero.

|

|

Client Profile

Michael and Becky have run an Anxiety Specialist Psychological Clinic for the last 6 years and have been working with All Accounted For since the very beginning.

We have helped thousands of clients with anxiety and have found that the need for psychological services like ours keeps growing. To help get anxiety assistance to more people, we’ve been working online through videos, courses and groups for the past year, which research shows can be just as effective for treating anxiety as face-to-face therapy.

Last month, we accelerated the launch of our flagship online membership - Anti-Anxiety Academy - so people can get started from their homes during this anxiety-provoking time. In it we share information, strategies and tools to help people to manage their anxiety and free themselves from fear. There’s also an exclusive group that members get to be a part of in order to get social support and discuss things with other people working through their own anxiety. We’re really excited about the potential this has for helping people – through the current turbulence and beyond.

You can currently join Anti-Anxiety Academy for just $1!

Click on the button below to check it out.