Firstly apologies for sending our third email in as many days. With the Government policies changing almost daily, we want to ensure our clients have access to update information, allowing us to collectively made quick decisions that will help your business ride through the tough economic conditions.

EMPLOYER WAGE SUBSIDY

As per our email yesterday with regards to the Governments stimulus package, we have worked through the aspect that will positively impact businesses in the short term, namely the wage subsidy.

The Government announced yesterday (17 March 2020), that they expected 50% of New Zealand small and medium sized businesses to access the employer wage subsidy, to assist with the retention of staff over the next 12 weeks. While for an initial period of 12 weeks, the wage subsidy could potentially be extended as part of the May 2020 budget, depending on the depth of the economic downturn.

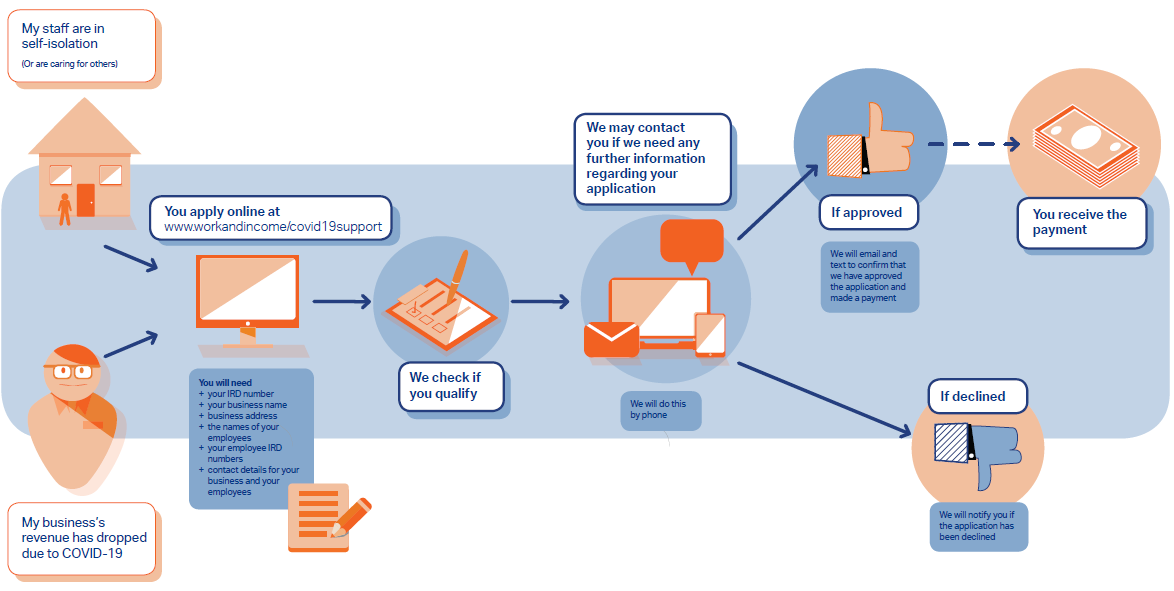

The wage subsidy scheme will be managed and operated by the Ministry of Social Development (MSD) on behalf of the Government.

While businesses have until 9 June 2020 to apply through MSD for the subsidy, they can start applying now if the business has evidence to support the revenue reduction requirements. We have already seen a number of clients that have been impacted by the Government policies combating the COVID-19 outbreak, particularly our hotelier and restaurant clients, due to reduced bookings. A number of our trade clients have also reported that their clients are putting projects on hold, while our childcare providers are under the constant threat of school closures, resulting in reduced bookings.

The purpose of the wage subsidy is to provide employers with an opportunity to digest the impacts of the looming economy downturn, assess how it will impact their business and whether they will need to restructure their business. The wage subsidy will provide some much needed breathing space and thinking time for business owners. The Government hopes the wage subsidy will also allow employers to hold onto staff for longer (meaning staff will stay on higher incomes than the unemployment benefit) and that it will spread the job loses over a longer period.

We have prepared a document that provides a plain English explanation around the eligibility criteria and outlines the key information required to apply for the wage subsidy. There is also a requirement to obtain in writing from staff, approving the disclosure of their personal information as part of the MSD application. We have developed and provided a template for employers to utilise for obtaining that consent; which you will find within the document. You can access the document from the below link:

Within the document, we have also provided details around the disclosure requirements and outlined the risks associated with providing false or misleading information. Please ensure you read this section carefully, as MSD has the ability to audit the application and criminally charge any employers providing inaccurate information.

The wage subsidy is available to both employers and also owner operator sole traders, though there are different application forms to prepare depending on the business category.

If you would like assistance with completing the application or would us to prepare the necessary revenue comparison or projections, please contact any of the All Accounted For team.

A reminder of the key aspects of the wage subsidy scheme

- Full time up to $585 a week (20 hours or more) for up to 12 weeks

- Part time up to $385 a week (less than 20 hours) for up to 12 weeks

- Paid as lump sum, up to maximum of $150,000 per business to retain employees

- Business have either suffered or projected to suffer a 30% decline in revenue compared to last year for any month between January and June 2020. Applications can be made on the basis of forecast revenue decline

- Must declare, on best endeavours, that will continue to employ affected employees at minimum of 80% of their income for the duration of the subsidy period

- Employers sign declaration that have taken active steps to mitigate the impact of COVID-19 (IE: engaged with Bank/Financial Advisor/Accountant)

- Applications to Ministry of Social Development

- Available from 17 March 2020 and applications can be made up until 9 June 2020

- Money to be paid out within 5 days

WE ARE HERE TO HELP

If you have concerns about the COVID-19 impacts on your business or want to know more about how the above stimulus package could help your business, please contact the All Accounted For team.

Email: admin@aafl.nz

Phone: 04-970-1182

|

|